what is suta tax texas

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. The amount of the tax is based on the employees wages and the states unemployment rate.

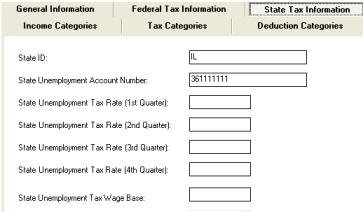

Texas Workforce Commission Account Granting Patriot Access

Since 2012 the Texas taxable wage base remains at 9000 for UI and the maximum UI Texas unemployment tax rate has fallen with the minimum going from 061.

. Each state establishes its. Overview Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by. The unemployment tax rate is calculated by multiplying the individuals salary by the regular unemployment insurance tax rate.

General Tax Rate Replenishment Tax Rate Unemployment Obligation Assessment Deficit Tax Rate and Employment and Training. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. You have employees with the.

Each of these employees earns an annual taxable income of 10000 bringing the total wages to 100000. Assume that your company receives a good assessment and your. An employers SUI rate is the sum of five components.

Each state establishes its. SUTA stands for State Unemployment Tax Act. The maximum FUTA tax an employer must pay per employee per.

SUTA was established to provide unemployment benefits to. Is Unemployment Taxed In 2021 In 2021 the. In such a case the tax is applied to the first 7000 in wages paid to.

Each state sets a range of minimum and maximum tax rates for SUTA taxes. SUTA stands for State Unemployment Tax Act. Employ one or more workers on at least one day in 20 or more different weeks during the current or preceding calendar year.

The states SUTA wage base is 7000 per employee. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. Since your business has no history of laying off employees your SUTA tax rate is 3.

Employers report their tax liability annually on IRS Form 940 but quarterly tax deposits may be required. Business employers are subject to SUTA tax if they. Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631.

This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages.

Suta Tax Requirements For Employers State By State Guide

Unemployment Tax Requirements For Texas Businesses Sst Accountants Consultants

Unemployment Insurance Tax Codes Tax Foundation

Unemployment Tax Information Texas Workforce Commission

2022 Federal State Payroll Tax Rates For Employers

A Complete Guide To Texas Payroll Taxes

Texas Workforce Commission On Twitter Understandingunemployment Question When Will I Get My 1099 G Unemployment Tax Form Answer We Will Be Sending Out 1099 G Tax Forms Out Through The Remainder Of January Learn

Free Unemployment And Payday Laws In Texas 2022

.jpg)

Tx State Wage Report Requires E Filing Das

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

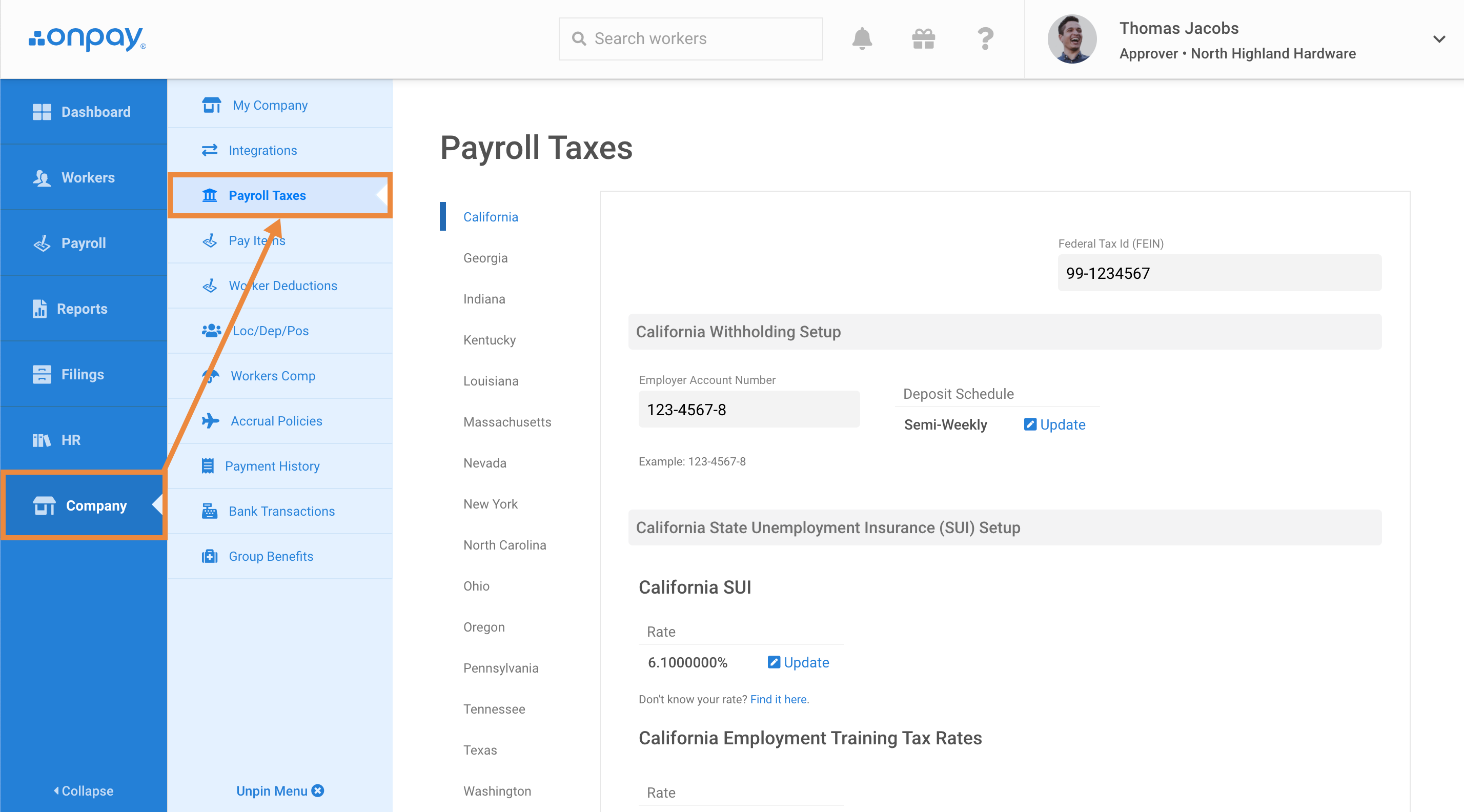

How To Update Your Sui Tax Rates And Deposit Schedule Help Center Home

2015 2022 Form Tx C 1 Fill Online Printable Fillable Blank Pdffiller

Unemployment Tax Rate Archives Vbr

If You Worked For The Federal Government Texas Workforce Commission

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Watch Thursday At 10 A M Texas Workforce Commission Hosts Texans Return To Work Roundtable